No products in the cart.

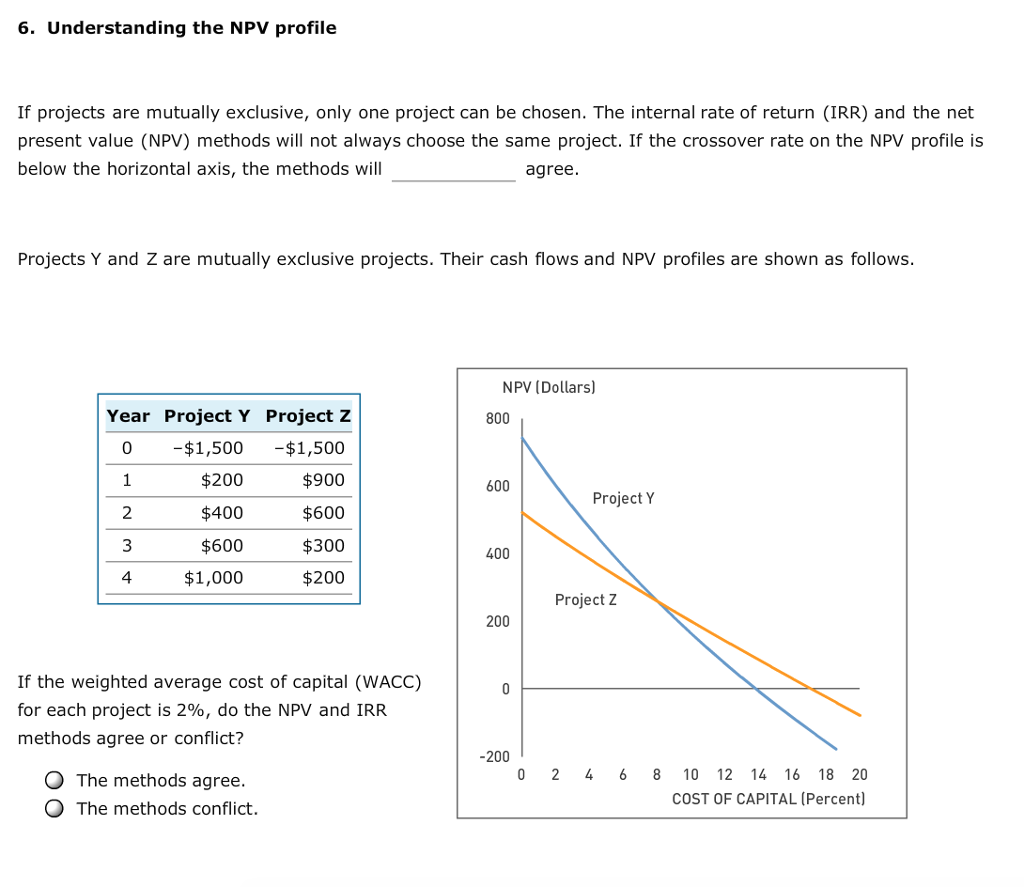

The discount rate used in NPV calculations is a critical factor in determining the result. A higher discount rate will result in a lower NPV, while a lower discount rate will result in a higher NPV. This is because a higher discount rate reflects a higher opportunity cost of investing in the project, while a lower discount rate reflects a lower opportunity cost. By considering the time value of money and the magnitude and timing of cash flows, NPV provides valuable insights for resource allocation and investment prioritization. NPV is also applied in the valuation of securities, such as bonds, by calculating the present value of their future cash flows and comparing it to the current market price. The point where the NPV crosses the x-axis (where the NPV is zero) is the NPV profile crossover rate.

Determining IRR

The NPV profile shows how the current-dollar return varies with the discount rate. The plot assumes a fixed discount rate and a fixed timing of cash flows. Net present value (NPV) compares the value of future cash flows to the initial cost of investment. This allows businesses and investors to determine whether a project or investment will be profitable.

- The time value of money is a fundamental concept in finance, which suggests that a dollar received today is worth more than a dollar received in the future.

- This is also true in the real world when the discount rate increases, the business has to put more money into the project; this increases the cost of the project.

- The steeper the curve, the more the project is sensitive to interest rates.

- The NPV Profile is a graphical representation that illustrates the relationship between the discount rate and the net present value of a project.

- However, what if an investor could choose to receive $100 today or $105 in one year?

- Sam’s purchasing of the embroidery machine involves spending money today in the hopes of making more money in the future.

Harnessing the Power of NPV Profile for Informed Decision Making

Inaccurate projections can lead to misleading NPV results and suboptimal decision-making. A zero NPV implies that the investment or project will neither generate a net gain nor a net loss in value. In this situation, decision-makers should carefully weigh the risks and potential benefits of the investment or project before making a decision. However, what if an investor could choose to receive $100 today or $105 in one year? The 5% rate of return might be worthwhile if comparable investments of equal risk offered less over the same period. For independent, conventional projects, the decision rules for the NPV and IRR will both draw the same conclusion on whether to invest or not.

Positive NPV

This team of experts helps Finance Strategists maintain the highest level of accuracy and professionalism possible. At Finance Strategists, we partner with financial experts to ensure the accuracy of our financial content. For information pertaining to the registration status of 11 Financial, please contact the state securities general journal description entries example regulators for those states in which 11 Financial maintains a registration filing. 11 Financial is a registered investment adviser located in Lufkin, Texas. 11 Financial may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements.

This is the project’s internal rate of return, which is the percentage the investment will recoup. The internal rate of return is the discount rate that makes the net present value of a project equal to zero, representing the project’s expected rate of return. Consider a scenario where there are two projects which are mutually exclusive. In our above example, when the rates are lower, project B performs better. It is the discount rate at which the NPV of an investment or project equals zero.

For example, by adjusting the cash flow projections, discount rate, or project timeline, we can observe the corresponding changes in the NPV profile. This analysis helps in assessing the project’s robustness and identifying potential risks. Let’s consider an investment project with an initial cost of $100,000 and expected cash inflows of $30,000 per year for five years. By discounting these cash flows at different rates, we can construct the NPV Profile. For instance, at a discount rate of 10%, the NPV might be $12,000, while at a discount rate of 15%, the NPV could be $5,000.

Another circumstance that may cause mutually exclusive projects to be ranked differently according to NPV and IRR criteria is the scale or size of the project. This is depicted in the graph where the two lines of Project A and Project B meet. Our goal is to deliver the most understandable and comprehensive explanations of financial topics using simple writing complemented by helpful graphics and animation videos.

The formula for calculating NPV involves taking the present value of future cash flows and subtracting the initial investment. The present value is calculated by discounting future cash flows using a discount rate that reflects the time value of money. When the interest rate increases, the discount rate used in the NPV calculation also increases. This higher discount rate reduces the present value of future cash inflows, leading to a lower NPV.

Small changes in the discount rate can lead to large variations in NPV, making it challenging to determine the optimal investment or project. A negative NPV indicates that the investment or project is expected to result in a net loss in value, making it an unattractive opportunity. In this case, decision-makers should consider alternative investments or projects with higher NPVs. A positive NPV indicates that the investment or project is expected to generate a net gain in value, making it an attractive opportunity. The higher the positive NPV, the more profitable the investment or project is likely to be. Using the discount rate, calculate the present value of each cash flow by dividing the cash flow by (1 + discount rate) raised to the power of the period in which the cash flow occurs.

As you embark on your next project evaluation, remember that the NPV profile is more than a graph—it’s a compass guiding you toward informed choices. Consider another project B, which requires an initial investment of $400 million and no cash flows in the next three years and $800 million in the last year. The reliability of NPV calculations is highly dependent on the accuracy of cash flow projections.